The bill, titled the End Debt Collector Abuse Act of 2012 (S 3350), is an update and expansion of earlier legislation Senator Franken proposed along with Senator George LeMieux of Florida in 2010. Like its predecessor, Franken's current bill would amend the Fair Debt Collection Practices Act to provide further protections for consumers against abusive or deceptive collection tactics sometimes employed by creditors and their agents.

But with this bill, Franken also

hopes to establish special protections for medical patients who are suffering

collection abuses when seeking care at hospitals and emergency rooms. Franken

announced his new bill at the conclusion of Senate hearings which explored debt

collection and health privacy practices of Chicago-based Accretive Health Inc.

and Fairview Health Services in Minnesota.

Standing Up For Patients

According to Franken, a member of

the Senate Health committee, too many patients are being harassed for payment

of medical bills when they are in a weakened, vulnerable state seeking urgent

medical services. Franken's updated End Debt Collector Abuse Act calls for

recognizing the "special nature" of medical debt and clarifying its

status under the FDCPA. As outlined in a bill summary available on Franken's

website, the bill would establish that:

1. Hospitals and their collection

agents are subject to FDCPA restrictions against abusive or deceptive

practices, regardless of whether the debt in question is in default

2. Collectors are prohibited from

approaching patients in hospital emergency rooms, labor and delivery

departments, and intensive care units

3. Hospitals are prohibited from

withholding, delaying or threatening to withhold emergency medical services

until a debt is paid

4. Collectors are required to inform

patients about any financial assistance programs such as hospital charity care

initiatives or Medicaid which might help pay their medical bills

Reinforcing the Federal Debt Collection

Practices Act

The bill goes on to restate the

central provisions of Franken and LeMieux's 2010 End Debt Collector Abuse Act.

Chief among these is an outright prohibition against creditors seeking arrest

warrants in order to compel consumers to pay off debts. While this practice is

not widely known or discussed outside of legal circles, debtors can be arrested

and jailed in some states for refusing to comply with court orders to repay

debt or for failing to attend certain debt-related court proceedings. Franken

points out that this practice flouts our nation's abolishment of debtors'

prisons, and furthermore exploits public law enforcement and court resources

for the benefit of private creditors.

Notably, Franken does not propose to

restrict courts from issuing arrest warrants in cases where a judge decides on

this course of action. Rather, Franken wants to ensure that courts - and not

creditors or their collection agents - will make such decisions.

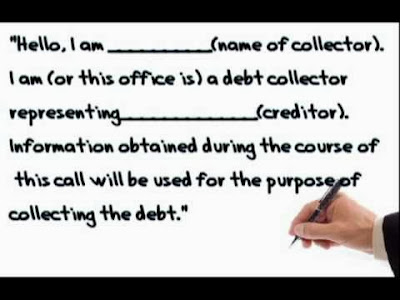

Besides prohibiting debt collectors

from issuing arrest warrants, Franken's End Debt Collector Abuse Act proposes

amendments to the Federal Debt Collection Practices Act which would require

collectors to provide additional information to consumers regarding their debt

and their rights under the law. Specifically, the new bill would require that

collectors provide:

1. The original creditor's name and

address - which can be unclear in situations where debts are bought and sold

several times by collection agencies before any collections are made

2. A full itemization of the

principal, interest and fees which comprise the total debt so that consumers

can understand what a collector is alleging, and dispute it point by point if

necessary

3. Instructions and contact

information for filing a complaint or dispute with the collector's organization

4. Thorough investigations in cases

where consumers dispute a debt, as well as verification specific to the

disputed issue

Finally, Franken's bill calls for

raising statutory damage limits set forth in the FDCPA and tying them to the

Consumer Price Index to adjust for inflation, noting that these limits have not

changed since the law's enactment almost 35 years ago in 1977. Franken feels

that raising these damage limits will more effectively punish bad actors in the

debt collection business and encourage all debt collectors to reexamine their

practices to help promote compliance.

Tidak ada komentar:

Posting Komentar